Benefits of the Mirador Platform

What they’re saying:

“I would give the experience working with Umpqua and Mirador’s digital small business loan application a 10 out of 10 and plan to work exclusively with both in the future whenever I need a loan.”

David, Umpqua Bank Borrower in Seattle, WA

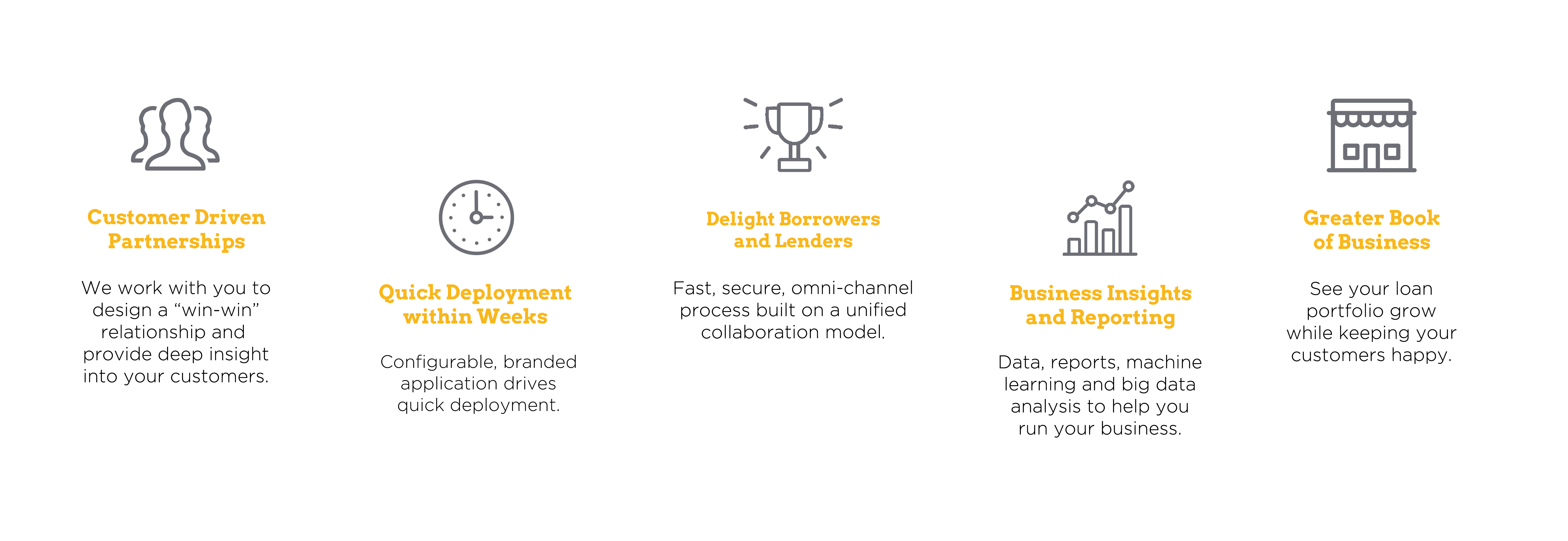

At Mirador, we are

passionate about helping businesses grow. The

Mirador platform provides a fast,

smart and

secure cloud-based experience that turns burdensome

paperwork into

a streamlined, efficient

process to delight borrowers and lenders.

We

work with banks, credit unions and financial

institutions across the country.

Among others, we’re proudly powering small business lending for:

Best-in-Class

Borrower Experience

The Net Promoter Score is used as a proxy for

gauging

the customer’s overall

satisfaction with a company’s product or

service.

Benchmarks: USAA: 75 |

OnDeck: 73

Apple iPhone: 63 | Goldman

Sachs: 3