The Mirador Network

Help your small business members access the funding they need to thrive.

Mirador enables

your organization to provide highly

pre-qualified loan options to your customers

from our

network of

banks, non-profit lenders and other low-cost

funding options.

“Small business lending has historically been a hassle for both borrowers and lenders, yet a small business loan is the primary driver of both new customer growth and customer retention. By providing an application process that is digital, efficient, and highly engaging and collaborative, financial institutions can better serve their customers and our network partners add a differentiating service to help their members grow their businesses.”

Trevor Dryer, CEO & Co-Founder

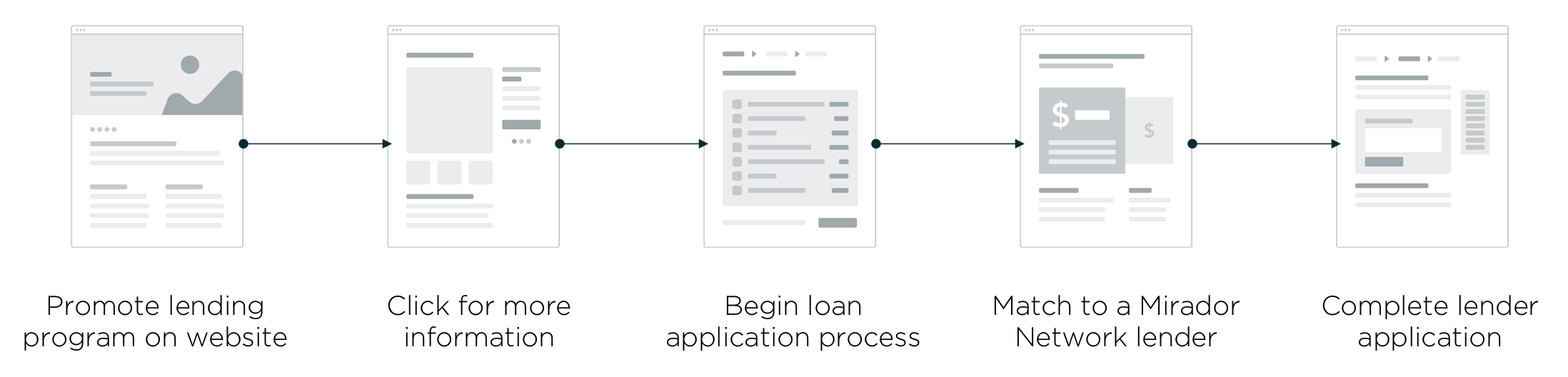

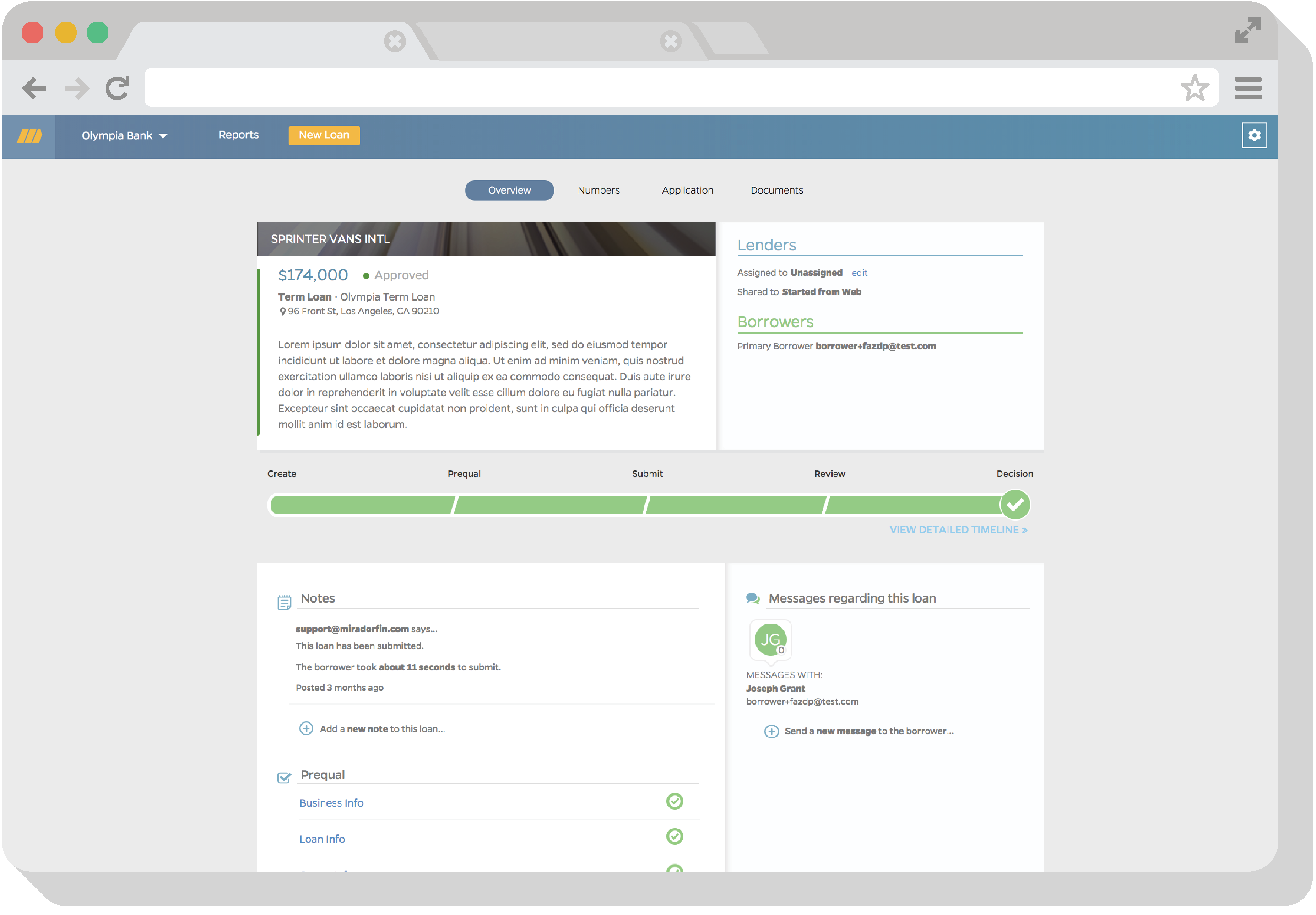

Digital Application Process

Applicants experience a simple 10-minute process vs 30+ hours of confusion. Mirador's online application enables borrowers to apply once and connect with multiple potential lenders. Once an application is started, the Mirador technology connects borrower and lender to ensure all required documentation is collected in the application so a decision can be made quickly. Most borrowers receive a decision in one week.

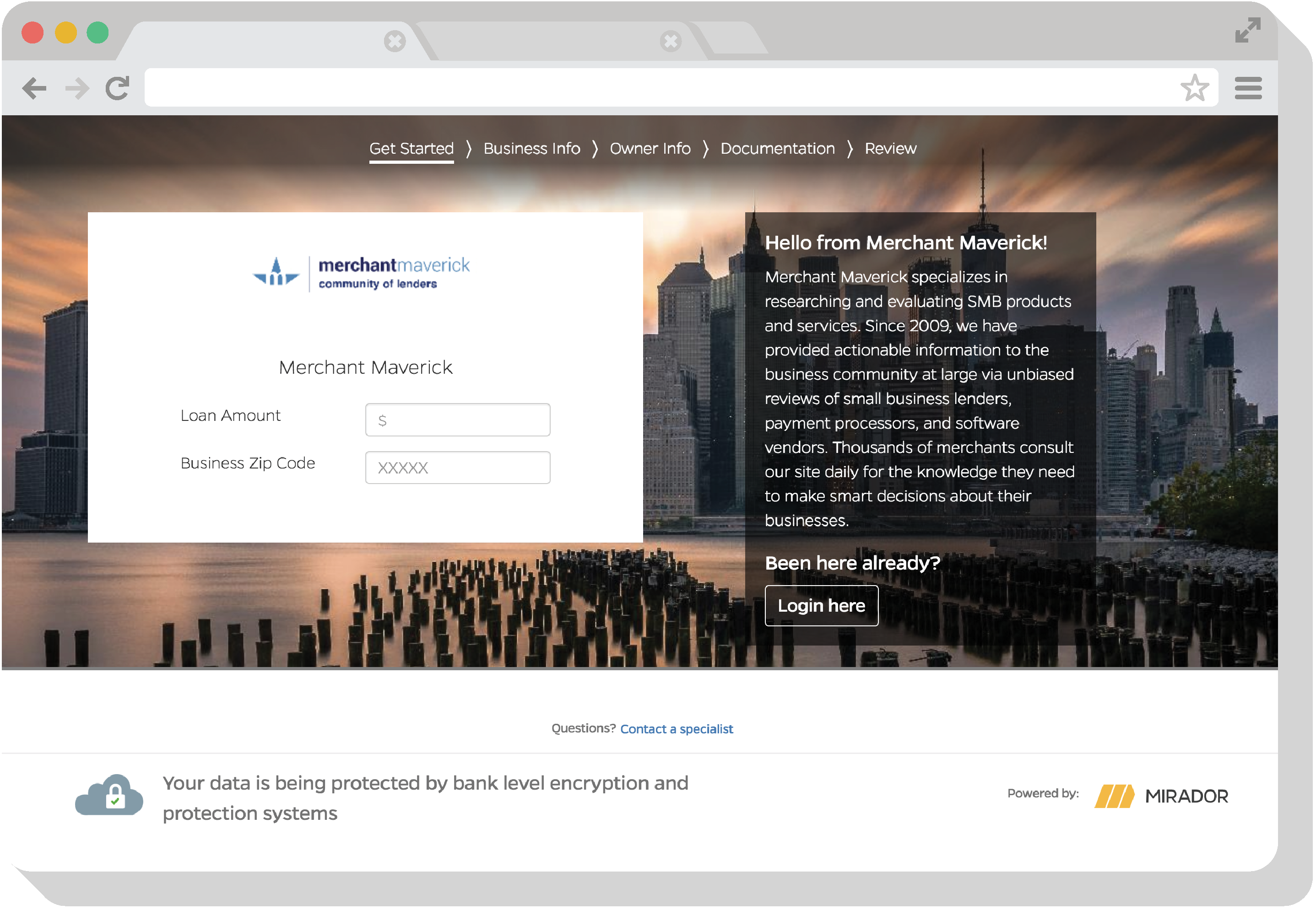

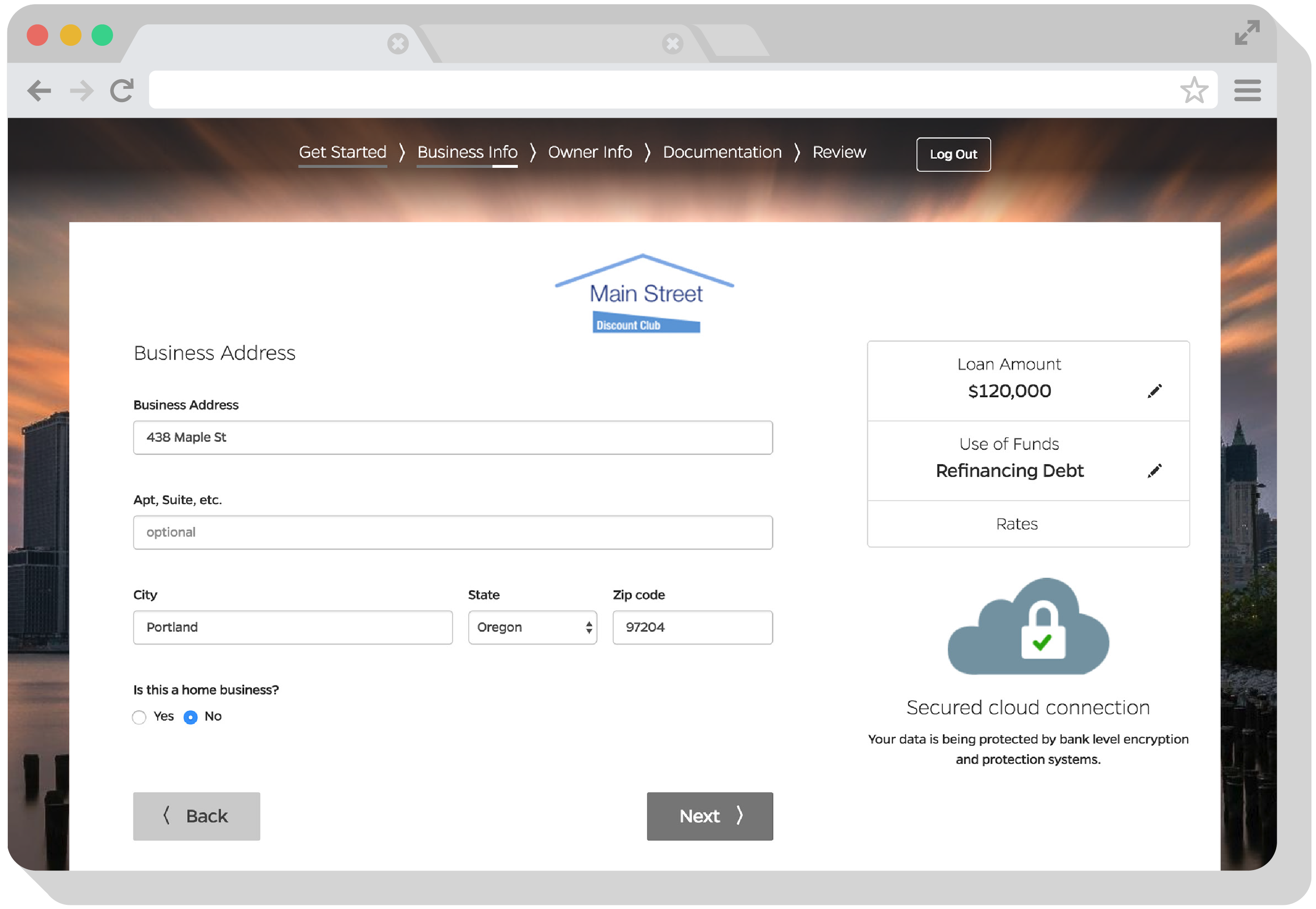

Your Customers, Your Brand

Build loyalty and increase customer satisfaction when

offering a small business loan platform. Mirador

partners with you to brand our platform as your

own.

Your customers applying for small

business loans correlate the simplicity of the

application experience with value driven by your

brand.

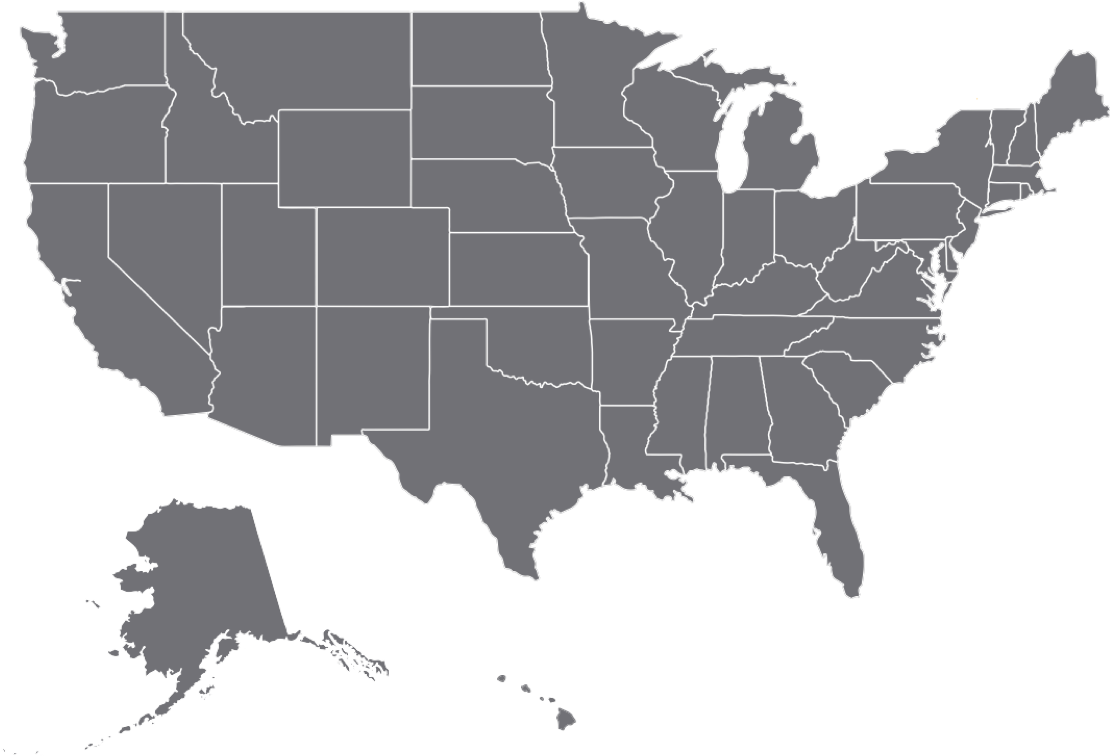

National Lending Coverage

The Mirador Network connects your customers with banks, credit unions and mission-driven lenders who are passionate about growing small businesses. The lenders fulfilling loans from the Mirador Network are also Mirador clients using our technology to expedite the application process for their traditional customers.

Member Benefits & Revenue

Small businesses need capital to grow, and with the Mirador Network, we make accessing funding easier than ever. The modern, streamlined interface drives average application completion rates of 59.4%. For loans that are funded, Mirador has a flexible incentive program to reward borrowers or your organization for the origination of that borrower.